Introduction: Navigating the Financial Waters of Global Top E-Commerce

跨境通 (Global Top E-Commerce) was once a shining star in China's cross-border e-commerce landscape. Its rapid growth and ambitious expansion strategies made it a key player in connecting Chinese sellers with global consumers. However, recent years have brought significant financial challenges, leading to speculation and uncertainty surrounding its future. One of the most pressing questions is: has 跨境通 entered pre-reorganization proceedings? Understanding the answer to this question, and the implications of such a move, is crucial for investors, suppliers, employees, and anyone involved in the cross-border e-commerce ecosystem. Pre-reorganization is a critical step for a company facing financial distress, offering a potential pathway to restructuring debt and revitalizing operations. This article will delve into the details surrounding 跨境通's financial situation, explore the concept of pre-reorganization, and analyze whether or not the company has indeed taken this step.

跨境通是否进入预重整程序? (Has Global Top E-Commerce Entered Pre-Reorganization Proceedings?)

What is Pre-Reorganization? A Lifeboat for Troubled Companies

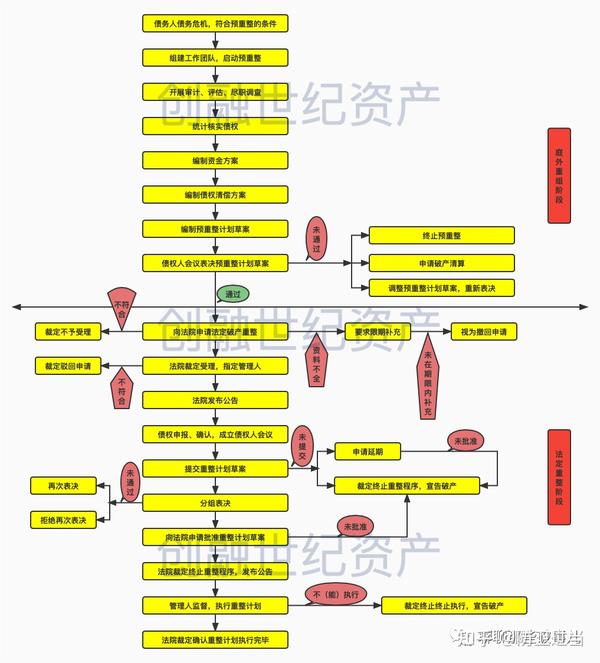

Before we delve into 跨境通's specific situation, it's important to understand what pre-reorganization actually entails. Pre-reorganization, also known as pre-packaged bankruptcy or pre-pack, is a structured process designed to facilitate a company's financial restructuring before formally filing for bankruptcy. It involves negotiating a reorganization plan with key creditors before initiating formal bankruptcy proceedings. The goal is to expedite the bankruptcy process, minimize disruption to the business, and ultimately emerge with a more sustainable financial structure.

Here's a breakdown of the key features of pre-reorganization:

- Negotiation with Creditors: The company works with its major creditors (banks, bondholders, suppliers, etc.) to develop a restructuring plan. This plan typically involves reducing debt, extending payment terms, or converting debt into equity.

- Pre-Agreed Plan: The restructuring plan is agreed upon by a significant majority of creditors before filing for bankruptcy. This agreement provides a higher degree of certainty and reduces the risk of protracted and costly legal battles.

- Streamlined Bankruptcy Process: Because a plan is already in place, the formal bankruptcy process can be significantly shorter and more efficient. The court's role is primarily to review and approve the pre-agreed plan.

- Business Continuity: Pre-reorganization aims to minimize disruption to the company's operations. Suppliers are more likely to continue doing business, and customers are less likely to be deterred by the bankruptcy proceedings.

跨境通's Financial Troubles: A Perfect Storm

To understand the possibility of 跨境通 entering pre-reorganization, we need to examine the factors contributing to its financial difficulties. Several issues have converged to create a challenging situation:

- Rapid Expansion and Acquisition: 跨境通 aggressively expanded its operations through acquisitions, often taking on significant debt to finance these deals. The integration of these acquired businesses proved more challenging than anticipated, leading to operational inefficiencies and increased costs.

- Intensified Competition: The cross-border e-commerce market is fiercely competitive. New players have emerged, and existing giants have intensified their efforts, putting pressure on 跨境通's market share and profit margins.

- Changes in Regulatory Environment: Evolving regulations in both China and international markets have impacted the cross-border e-commerce industry. Changes in tax policies, customs regulations, and data privacy laws have increased compliance costs and created uncertainty.

- COVID-19 Pandemic: The pandemic disrupted global supply chains and impacted consumer spending patterns. While e-commerce saw a surge in demand initially, logistical challenges and economic uncertainty negatively affected many businesses, including 跨境通.

- Internal Control Issues: Reports of internal control weaknesses and potential financial irregularities have further eroded investor confidence and added to the company's woes.

Evidence Suggesting Pre-Reorganization Possibilities (and Counterarguments)

While an official announcement confirming 跨境通's entry into pre-reorganization proceedings might be pending or subject to confidentiality agreements, several pieces of evidence point towards this possibility. Conversely, we must also consider counterarguments:

- Debt Restructuring Efforts: News reports and market rumors have suggested that 跨境通 has been actively engaging with creditors to negotiate debt restructuring plans. This is a key characteristic of pre-reorganization.

- Counterargument: Debt restructuring negotiations are common for companies facing financial difficulties and don't necessarily indicate pre-reorganization. Companies often try to resolve issues outside of formal bankruptcy proceedings.

- Asset Disposal: 跨境通 has reportedly been selling off assets, including some of its subsidiaries and real estate holdings. This could be a move to raise cash to pay down debt or to streamline operations in preparation for a restructuring.

- Counterargument: Asset disposal could simply be a strategic move to refocus the business and improve its financial position, without resorting to pre-reorganization.

- Court Filings (or Lack Thereof): Monitoring court filings in the relevant jurisdictions (typically where the company is headquartered and where its major assets are located) is crucial. The absence of public filings doesn't necessarily rule out pre-reorganization, as some negotiations can be kept confidential until a plan is finalized.

- Counterargument: The absence of public court filings is a strong indicator that the company has not yet entered formal pre-reorganization proceedings.

- Statements from Company Management: Official statements from 跨境通's management regarding its financial situation and restructuring efforts provide valuable clues. However, companies are often cautious in their public communications during sensitive periods.

- Counterargument: Management may downplay the severity of the situation or offer optimistic projections to maintain investor confidence, even if pre-reorganization is being considered.

Important Considerations if Pre-Reorganization Occurs

If 跨境通 has entered or is considering pre-reorganization, several important considerations come into play:

- Impact on Suppliers: Suppliers should closely monitor the situation and assess their exposure to 跨境通. Negotiating new payment terms or securing guarantees can help mitigate potential losses.

- Impact on Customers: Customers may experience disruptions in service or delivery if the company is undergoing significant restructuring. However, pre-reorganization aims to minimize such disruptions.

- Impact on Employees: Pre-reorganization often involves layoffs or restructuring of the workforce. Employees should seek legal advice and explore their options.

- Investor Implications: Investors should carefully assess the risks and potential rewards of investing in a company undergoing pre-reorganization. The value of their holdings may be significantly affected.

- The Restructuring Plan: The success of the pre-reorganization hinges on the viability of the restructuring plan. Creditors and stakeholders should carefully review the plan and assess its feasibility.

Tips for Stakeholders

- Stay Informed: Closely monitor news reports, financial filings, and official statements from 跨境通.

- Seek Professional Advice: Consult with legal and financial advisors to understand your rights and options.

- Assess Your Exposure: Evaluate your financial exposure to 跨境通 and take steps to mitigate potential losses.

- Communicate with the Company: If you are a supplier or creditor, communicate with 跨境通's management to understand their plans and negotiate mutually beneficial terms.

Potential Challenges and Solutions

Pre-reorganization is not without its challenges. Some potential hurdles include:

- Lack of Creditor Consensus: Reaching an agreement with all creditors can be difficult, especially if there are conflicting interests.

- Solution: Mediation and negotiation can help bridge the gap between creditors and find common ground.

- Market Uncertainty: Economic conditions and market sentiment can impact the success of the restructuring plan.

- Solution: Develop a flexible restructuring plan that can adapt to changing market conditions.

- Operational Challenges: Implementing the restructuring plan can be complex and may require significant operational changes.

- Solution: Develop a clear implementation plan and ensure strong leadership to guide the company through the restructuring process.

Table: Key Information Regarding 跨境通 and Pre-Reorganization

| Feature | Description | Relevance to 跨境通 |

|---|---|---|

| Definition of Pre-Reorganization | A structured process for restructuring a company's finances before formally filing for bankruptcy, involving negotiation with creditors. | Highly relevant, given 跨境通's reported debt restructuring efforts and asset disposal, suggesting a potential attempt to resolve financial issues before a formal bankruptcy filing. |

| Key Benefits | Expedited bankruptcy process, minimized disruption, business continuity, higher certainty. | These benefits would be highly desirable for 跨境通, as they would help maintain supplier relationships, customer confidence, and operational stability during a challenging period. |

| Key Challenges | Lack of creditor consensus, market uncertainty, operational challenges. | These challenges are particularly relevant given the complex nature of 跨境通's debt structure, the volatile cross-border e-commerce market, and the potential for operational disruptions during restructuring. |

| Evidence Suggesting Pre-Reorganization | Debt restructuring efforts, asset disposal, court filings (or lack thereof), statements from company management. | These indicators, especially debt restructuring and asset disposal, are being closely watched to determine if 跨境通 is pursuing pre-reorganization. The absence of public court filings doesn't necessarily rule it out, but the lack of official confirmation from the company creates uncertainty. |

| Impact on Suppliers | Potential for payment delays or defaults, need to renegotiate terms. | Suppliers to 跨境通 should be proactive in assessing their exposure and negotiating new payment terms to mitigate potential losses. |

| Impact on Customers | Potential for disruptions in service or delivery. | 跨境通 needs to prioritize customer communication and ensure that any restructuring efforts minimize disruptions to service and delivery to maintain customer loyalty. |

| Impact on Investors | Significant risk to investment value. | Investors in 跨境通 should carefully assess the risks and potential rewards of investing in a company undergoing restructuring and seek professional financial advice. |

| Current Status (as of this writing) | Uncertain; no official confirmation of pre-reorganization. | The situation remains fluid. Monitoring news reports, financial filings, and company statements is crucial to stay informed. A formal announcement from 跨境通 would provide much-needed clarity. |

Frequently Asked Questions (FAQ)

-

Q: What does it mean for 跨境通 if it enters pre-reorganization?

- A: It means the company is attempting to restructure its debt and operations under court supervision to become financially sustainable. It's a sign of financial distress, but also a potential path to recovery.

-

Q: Will I still receive my orders if 跨境通 is in pre-reorganization?

- A: The goal of pre-reorganization is to minimize disruption to operations. However, there may be some delays or changes in service. It's best to monitor the situation closely and check for updates from 跨境通.

-

Q: What should I do if I am a supplier to 跨境通?

- A: Seek legal and financial advice, assess your exposure, and communicate with 跨境通's management to understand their plans and negotiate mutually beneficial terms.

-

Q: Is it a good time to invest in 跨境通 if it's in pre-reorganization?

- A: Investing in a company undergoing pre-reorganization is highly risky. Consult with a financial advisor and carefully assess the potential risks and rewards before making any investment decisions.

-

Q: Where can I find the latest information on 跨境通's financial situation?

- A: Monitor news reports, financial filings, and official statements from the company.

Conclusion: Navigating Uncertainty in the Cross-Border E-Commerce Landscape

The question of whether 跨境通 has entered pre-reorganization remains unanswered definitively at the time of writing. However, the company's financial challenges and reported efforts to restructure its debt suggest that it is a strong possibility. Understanding the concept of pre-reorganization, its potential benefits and challenges, and its implications for various stakeholders is crucial for navigating this period of uncertainty. While the future of 跨境通 remains unclear, proactive monitoring and informed decision-making are essential for all parties involved. The situation highlights the dynamic and competitive nature of the cross-border e-commerce industry and the importance of sound financial management and adaptability in the face of evolving market conditions. Only time will tell if 跨境通 can successfully navigate these financial waters and emerge as a revitalized force in the global e-commerce arena.